Public Accounting License Requirements . To be eligible for registering as a public accountant, you must meet the following registration requirements: The oversight committee has notified the public accountant in writing that the public accountant must not be or must cease to be an audit. (i) at least 21 years. This guide provides information on the prescribed professional. To be eligible for registering as a public accountant, you must meet the following registration requirements: “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. A public accountant can provide public accountancy services such as audit and reporting on financial statements, and such other. Professional requirements for registration as public accountants. With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: My collections allows you to create your personal lists of. (i) at least 21 years.

from www.templateroller.com

(i) at least 21 years. My collections allows you to create your personal lists of. “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. This guide provides information on the prescribed professional. With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: To be eligible for registering as a public accountant, you must meet the following registration requirements: Professional requirements for registration as public accountants. To be eligible for registering as a public accountant, you must meet the following registration requirements: A public accountant can provide public accountancy services such as audit and reporting on financial statements, and such other. (i) at least 21 years.

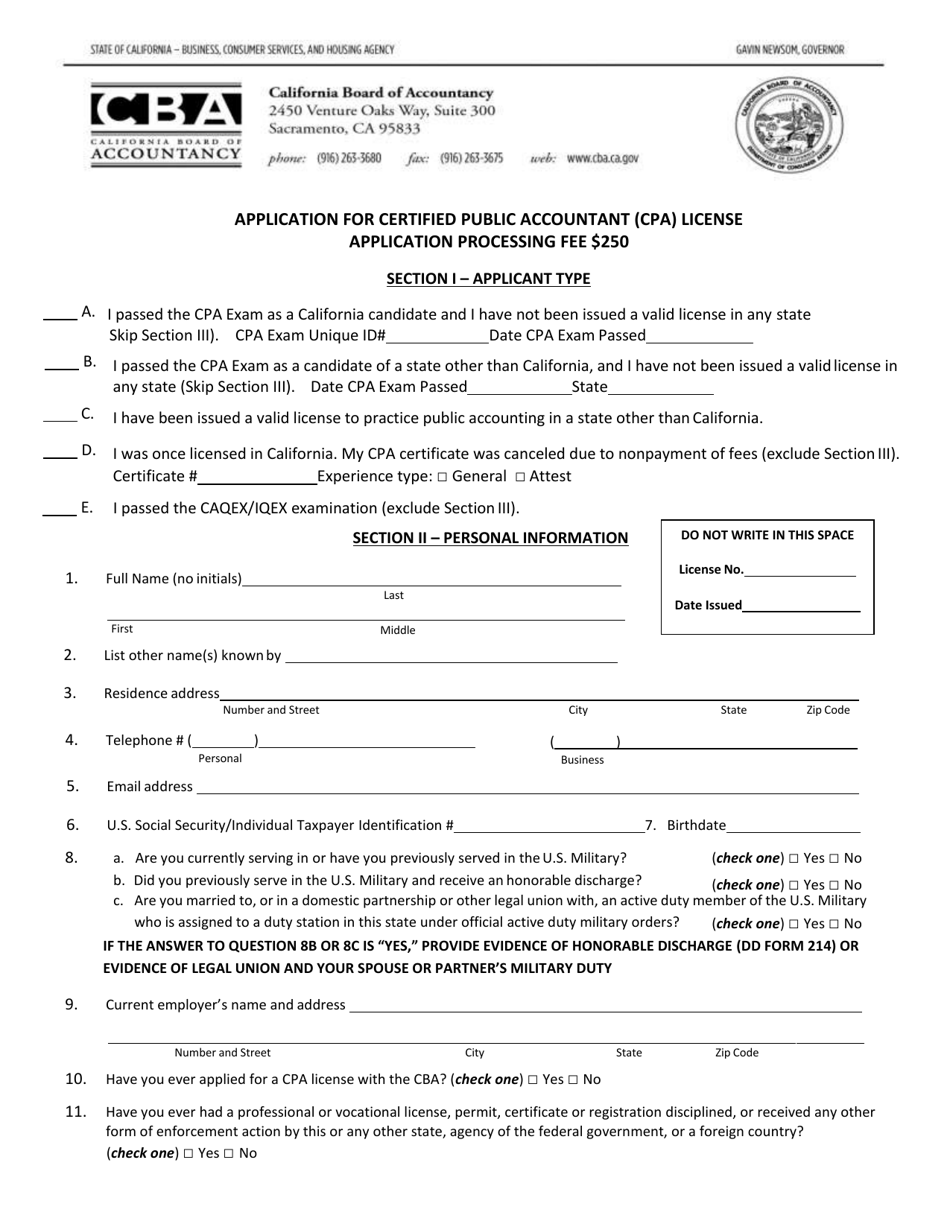

California Application for Certified Public Accountant (CPA) License

Public Accounting License Requirements “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. To be eligible for registering as a public accountant, you must meet the following registration requirements: (i) at least 21 years. The oversight committee has notified the public accountant in writing that the public accountant must not be or must cease to be an audit. A public accountant can provide public accountancy services such as audit and reporting on financial statements, and such other. To be eligible for registering as a public accountant, you must meet the following registration requirements: With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: (i) at least 21 years. “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. This guide provides information on the prescribed professional. My collections allows you to create your personal lists of. Professional requirements for registration as public accountants.

From www.linkedin.com

It’s Tax Day! Have You Ever Considered a Career in Accounting? Public Accounting License Requirements To be eligible for registering as a public accountant, you must meet the following registration requirements: With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: (i) at least 21 years. This guide provides information on the prescribed professional. (i) at least 21 years. Professional requirements for registration as public. Public Accounting License Requirements.

From www.ladinez.com

Filipino CPA Los Angeles Public Accounting License Requirements (i) at least 21 years. “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. To be eligible for registering as a public accountant, you must meet the following registration requirements: A public accountant can provide public accountancy services such as audit and reporting on financial. Public Accounting License Requirements.

From bluesignal.com

Accounting Certifications to Advance Your Career Blue Signal Search Public Accounting License Requirements The oversight committee has notified the public accountant in writing that the public accountant must not be or must cease to be an audit. A public accountant can provide public accountancy services such as audit and reporting on financial statements, and such other. “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner. Public Accounting License Requirements.

From www.uslegalforms.com

Certificate Of General Experience Public Accounting California Public Accounting License Requirements This guide provides information on the prescribed professional. “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. (i) at least 21 years. (i) at least 21 years. To be eligible for registering as a public accountant, you must meet the following registration requirements: With effect. Public Accounting License Requirements.

From ez-cpe.com

New York State Board for Public Accountancy Public Accounting License Requirements (i) at least 21 years. My collections allows you to create your personal lists of. The oversight committee has notified the public accountant in writing that the public accountant must not be or must cease to be an audit. (i) at least 21 years. With effect from 1 january 2019, an individual who wishes to be registered as a public. Public Accounting License Requirements.

From bluesignal.com

Accounting Certifications to Advance Your Career Blue Signal Search Public Accounting License Requirements To be eligible for registering as a public accountant, you must meet the following registration requirements: (i) at least 21 years. With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: This guide provides information on the prescribed professional. (i) at least 21 years. To be eligible for registering as. Public Accounting License Requirements.

From www.cpajournal.com

Building a Stronger Pipeline The CPA Journal Public Accounting License Requirements This guide provides information on the prescribed professional. With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: My collections allows you to create your personal lists of. “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or. Public Accounting License Requirements.

From unugtp.is

How To Get Cpa License unugtp Public Accounting License Requirements Professional requirements for registration as public accountants. My collections allows you to create your personal lists of. This guide provides information on the prescribed professional. To be eligible for registering as a public accountant, you must meet the following registration requirements: (i) at least 21 years. (i) at least 21 years. “public practice” means practice as a public accountant in. Public Accounting License Requirements.

From asosplus.weebly.com

asosplus Blog Public Accounting License Requirements A public accountant can provide public accountancy services such as audit and reporting on financial statements, and such other. With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: My collections allows you to create your personal lists of. (i) at least 21 years. “public practice” means practice as a. Public Accounting License Requirements.

From nacpb.org

America's 1 Accounting License NACPB Public Accounting License Requirements “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: A public accountant can provide public accountancy services such as audit and reporting on financial statements,. Public Accounting License Requirements.

From studylib.net

Public Accounting Licence Requirements for Assurance Public Accounting License Requirements (i) at least 21 years. (i) at least 21 years. With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: This guide provides information on the prescribed professional. The oversight committee has notified the public accountant in writing that the public accountant must not be or must cease to be. Public Accounting License Requirements.

From www.pdfprof.com

aca certification accounting Public Accounting License Requirements A public accountant can provide public accountancy services such as audit and reporting on financial statements, and such other. The oversight committee has notified the public accountant in writing that the public accountant must not be or must cease to be an audit. To be eligible for registering as a public accountant, you must meet the following registration requirements: (i). Public Accounting License Requirements.

From bantayilocossur.gov.ph

Business Permit Application Municipality of Bantay, Ilocos Sur Public Accounting License Requirements To be eligible for registering as a public accountant, you must meet the following registration requirements: (i) at least 21 years. To be eligible for registering as a public accountant, you must meet the following registration requirements: This guide provides information on the prescribed professional. (i) at least 21 years. A public accountant can provide public accountancy services such as. Public Accounting License Requirements.

From www.financestrategists.com

Certified Public Accountant (CPA) Definition, Qualification, Role Public Accounting License Requirements Professional requirements for registration as public accountants. (i) at least 21 years. My collections allows you to create your personal lists of. To be eligible for registering as a public accountant, you must meet the following registration requirements: To be eligible for registering as a public accountant, you must meet the following registration requirements: “public practice” means practice as a. Public Accounting License Requirements.

From www.jimersonfirm.com

Certified Public Accountant (“CPA”) Licenses Jimerson Birr Public Accounting License Requirements “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. With effect from 1 january 2019, an individual who wishes to be registered as a public accountant will need to: A public accountant can provide public accountancy services such as audit and reporting on financial statements,. Public Accounting License Requirements.

From www.templateroller.com

California Application for Certified Public Accountant (CPA) License Public Accounting License Requirements My collections allows you to create your personal lists of. “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. To be eligible for registering as a public accountant, you must meet the following registration requirements: Professional requirements for registration as public accountants. A public accountant. Public Accounting License Requirements.

From www.selecthub.com

Accounting Software System Requirements Checklist Public Accounting License Requirements This guide provides information on the prescribed professional. “public practice” means practice as a public accountant in the capacity of a sole proprietor, a partner in an accounting firm or a corporate. Professional requirements for registration as public accountants. (i) at least 21 years. My collections allows you to create your personal lists of. With effect from 1 january 2019,. Public Accounting License Requirements.

From learn.g2.com

3 CPA Requirements for the Aspiring Public Accountant Public Accounting License Requirements (i) at least 21 years. A public accountant can provide public accountancy services such as audit and reporting on financial statements, and such other. (i) at least 21 years. This guide provides information on the prescribed professional. My collections allows you to create your personal lists of. “public practice” means practice as a public accountant in the capacity of a. Public Accounting License Requirements.